Structured finance is a distinct financing scheme whereby an originator or parent institution transfers a multitude of credit or similar receivable assets, and the right to their respective cash flows to a financial intermediary institution collectively. The intermediary institution then structures and issues an “asset-backed security” or ABS, backed by the acquired asset pool and related cash flows, to finance the originator, thus providing a higher credibility instrument with respect to the numerous distributed receivables. When numerous receivables with different characteristics and distributed nature are structured to form a single security and issued, the risk is transferred to investors, while the originator gains access to liquidity. Through this securitization process and its products, which serve as a liquidity provider in the financial market, originator institutions transfer their risks and obtain liquidity at a discount, while investors with surplus funds and risk-taking capacity earn returns in exchange.

The practice of securitization in Turkey is regulated by the Capital Markets Board (SPK) Communiqué Series III, No: 58.1, titled “Communiqué on Asset-Backed Securities”. According to this regulation, authorized institutions for securitization in Turkey are: 1) Financing companies, 2) Financial leasing companies, 3) Banks and investment banks, 4) Mortgage finance institutions, 5) Broadly authorized intermediary institutions. While the first two can only structure and issue their own receivables, the others can also structure receivables from other originators and issue securities.

According to the regulations, a “founder” company in the mentioned categories creates a legal entity called a “special purpose vehicle” or SPV for each issuance. Under the necessary default isolation and guarantee mechanisms, the underlying assets are transferred from the originator to this fund and structured. The Issuer Fund can categorize underlying assets based on maturity, risk criteria, or other criteria and define tranches at different seniority levels, issuing bonds with different yields and payment conditions.

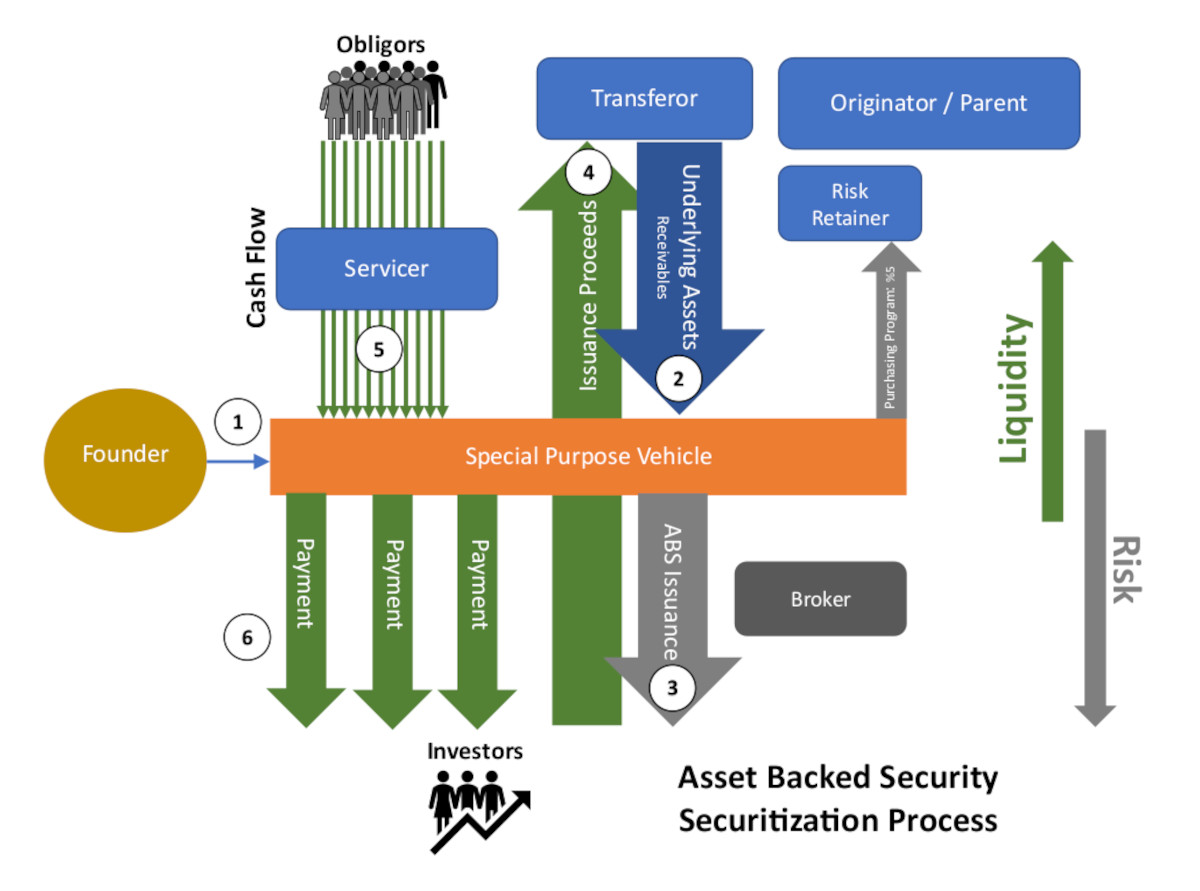

The typical process and parties involved in securitization are illustrated in the following graph:

- The founder financial institution establishes an “Asset (or Mortgage) Backed Financing Fund” (Special Purpose Vehicle).

- The Originator transfers credit receivables to the Asset Financing Fund as “underlying assets”. In some cases, another party may compile receivables from multiple source institutions, designated as the “Transferor” party, distinct from the Originator(s).

- The Asset Financing Fund structures credit receivables from numerous obligors based on risk criteria, maturities, or other criteria, defines the ABS tranches to be issued, along with related yield and payment terms, and through a “Financial Intermediary,” conducts the issuance either by public offering in the organized market or selling to qualified investors. As per regulations, at least 5% of the issued securities are purchased by the originator, fund, or a third-party “Risk Retainer” to create additional security.

- The “Issuance proceeds” are paid to the source institution under specified conditions, thus providing the required financing.

- The designated “Servicer” (often the originator itself) conducts the collection from obligors at maturity, tracks defaults, earns interest on accumulated funds, and…

- Executes payments to investors at specified maturities.